Click here to setup an account and get a free stock!

Stipulations: Must be approved for a Robinhood account and link your bank account. 18+ only.

There are plenty of stock trading apps out there but I’m going to tell you about my favorite one today. If you don’t know what you’re doing when it comes to stocks and trading this one is the next step up from Stash or Acorns. While the others will pretty much take care of the trading for you for $1 a month (which sounds cheap at first but really you’re losing a good percentage of your gains) but Robinhood is free! They make money off of uninvested money that is sitting in your account by lending it to others. Don’t worry about that though, it all goes on in the back end and you’ll never even know it. You can make extra money off of letting money sit in your account too if you get the Robinhood debit card and gain 0.3% APY!

What should I buy?

If went into the specifics of trading and tips this blog post would be a mile long. You can make a lot of money or lose a lot if you’re not careful. For something more in depth I’d recommend Investopedia for research but if you’re on this blog post you’re a set and forget person like me that doesn’t like to play the market too much. I like the sweet dividend gains (money companies pay you for investing in their stock). Not all stocks have dividends and even if they do pay dividends you can still lose money if the price of the stock falls and doesn’t come back up. To minimize that risk I’d suggest an ETF (Exchange Traded Fund) which is kind of like a single stock that combines bits of other stocks.

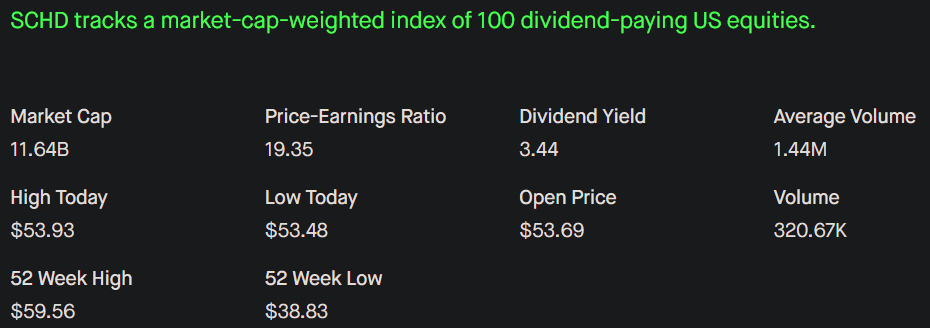

Lets look at the above picture of Schwab US Dividend Equity ETF (SCHD).

- Market Cap refers to the total value of all a company’s shares of stock.

- Today’s High and Low is pretty self explanatory, the market is open from 9:30-4 EST Monday through Friday. Open Price is the price it started at when the market opened.

- 52 Week High and Low just shows you the range of the stock in the past 52 weeks

- Price-Earnings Ratio helps investors determine the market value of a stock as compared to the company’s earnings. Click here to read more on this.

- Volume refers to the number of shares traded in a given time period. Average Volume is how much is traded in a day usually.

- Dividend Yield, expressed as a percentage, is a financial ratio (dividend/price) that shows how much a company pays out in dividends each year relative to its stock price.

Dividend Yield and P/E ratio is typically what I focus on. You may want to check to see if their dividend payout changes a lot but that could be skewed especially with this years COVID crash. With the information in the picture above we can see that there is a 3.44% yield which is pretty good. Anything over 3% is pretty solid in my opinion but you have two options of see how much you’ll get paid for the stock, you can do the math yourself or you can look it up on the NASDAQ website. If you can’t find the info on there you should be able to find the information after a quick Google search.

Why would choose a stock that doesn’t pay a dividend?

Typically dividend stocks don’t have as high of capital gains as non dividend stocks. What this means is that the stock price of a dividend yielding stock may not increase as much as one that doesn’t yield. For example I invested in Twilio and it doesn’t pay dividends at all but it looked promising.

As you can see above you can see the 1 day chart and the gains/loss for the day. Below that you see your market value if you own the stock. That will show you how much you paid for it and how much it has increased since you bought it (I could only afford one share at that time and they also didn’t let you purchase partial shares at that time). If you have multiple shares that you bought at different prices that will show up in the column next to it and show you your average. If your stocks drop but you still think it’s a great stock then it’s a good idea to buy some when the price drops. Try to buy low and sell high! It’s hard to time the market but you can do pretty well with some practice (and luck). Obviously I was pretty lucky in that my stock has gained 114% but since I haven’t sold it this is an UNREALIZED GAIN.

Unrealized vs Realized Gains/Losses and Taxes

While I won’t go in depth (click here for more details) you never make money or lose money from a stock unless you sell a stock. That’s where your capital gain/loss taxes come in as well. If you hold on to a stock for at least 1 year you’ll be taxed less. To read about the particulars of the taxes click here. Really what I’m getting at is pick something you believe in and stick with it, if the price goes down some it’s no big deal, it could recover, if it goes up then that is great! You could sell it if you like or hang on to it to see if the price continues to grow.

Above is my entire profile, that is me putting in only $5 a week (mostly) and reinvesting dividends. That is over the course of 4 years, for some time period I didn’t add any money and sometimes I’d add a little extra but for the most part it’s all from just putting $5 a week back and saving for the future. Oh and I have a 401k so don’t worry I’m not completely broke 😂. If you’re not putting money into your 401k where you work then you should do that first and foremost instead of trying to beat the market with Robinhood. Besides most companies will match your investments to a certain percent. If you don’t have access to a 401k and you want to find something safe here is a list of pretty safe ETFs that I would recommend checking out.

AOR $47.91 IEFA $60.22 SCHD $53.79 IVV $327.24 AOM $40.87 VWO $43.21 IJH $185.36 VB $151.90 IUSB $54.85

Leave a comment